With headlines focused on trade, we thought it important to provide broader context related to company fundamentals and earnings.

At this point, almost all S&P 500 companies have reported results, as have a host of core Canadian blue-chip companies. Earnings growth expectations in Canada remains +11% for 2025, and broad based.

Key takeaways:

As headlines centre on economic uncertainty, strong earnings growth is positive news. Earnings support stock prices and operating cash flow remains positive to support dividends and dividend growth.

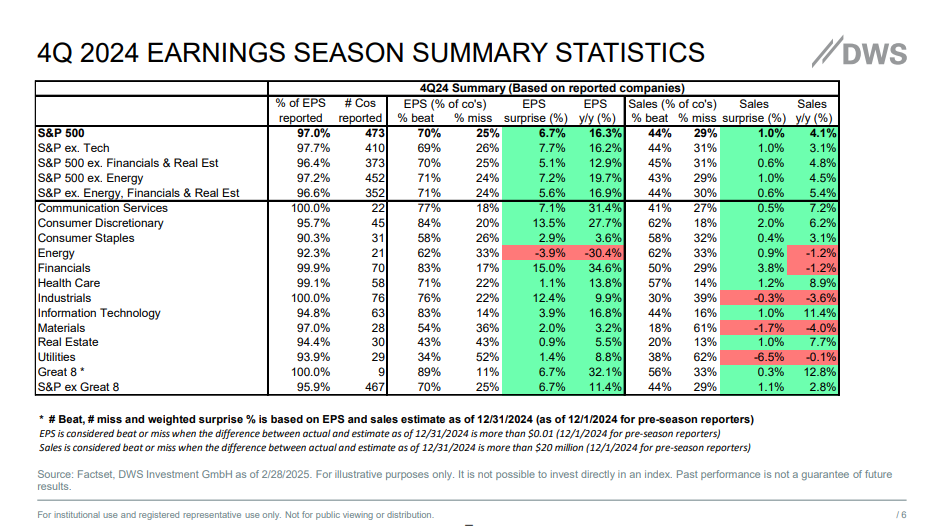

The chart below highlights S&P 500 earnings, including upside surprises with 70% of companies reporting ahead of expectations.

At this point, almost all S&P 500 companies have reported results, as have a host of core Canadian blue-chip companies. Earnings growth expectations in Canada remains +11% for 2025, and broad based.

Key takeaways:

- In the U.S., Q4 earnings rose 18 percent year over year – well beyond analyst expectations and the biggest gain since the bounce following the COVID period of 2021

- Margins improved materially by 1.3% to 12.6%

- Revenues increased by 5%

As headlines centre on economic uncertainty, strong earnings growth is positive news. Earnings support stock prices and operating cash flow remains positive to support dividends and dividend growth.

The chart below highlights S&P 500 earnings, including upside surprises with 70% of companies reporting ahead of expectations.

In the Canadian context, and notably last week, the major banks including TD, RBC and CIBC reported earnings per share above consensus.

Jennifer Nowski, Portfolio Manager at TD Asset Management, recently discussed Canadian public companies with Greg Bonnell of TD's MoneyTalk. Please click the link below to view:

(https://www.moneytalkgo.com/video/can-earnings-growth-offset-trade-headwinds-for-canada/)

Evidence-based thinking and allocating portfolio capital appropriately to meet the short and longer-term needs of our clients remains.

Please let Daniel and I know if you have any questions or wish to discuss.

Enjoy the start of March and more favourable weather… hopefully!

Jennifer Nowski, Portfolio Manager at TD Asset Management, recently discussed Canadian public companies with Greg Bonnell of TD's MoneyTalk. Please click the link below to view:

(https://www.moneytalkgo.com/video/can-earnings-growth-offset-trade-headwinds-for-canada/)

Evidence-based thinking and allocating portfolio capital appropriately to meet the short and longer-term needs of our clients remains.

Please let Daniel and I know if you have any questions or wish to discuss.

Enjoy the start of March and more favourable weather… hopefully!

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.