Honest

We act honestly, in good faith, and strictly in the best interest of our clients.

We act honestly, in good faith, and strictly in the best interest of our clients.

We act as responsible stewards of your wealth.

We believe investment decisions must be independent, free of bias and what's right for you.

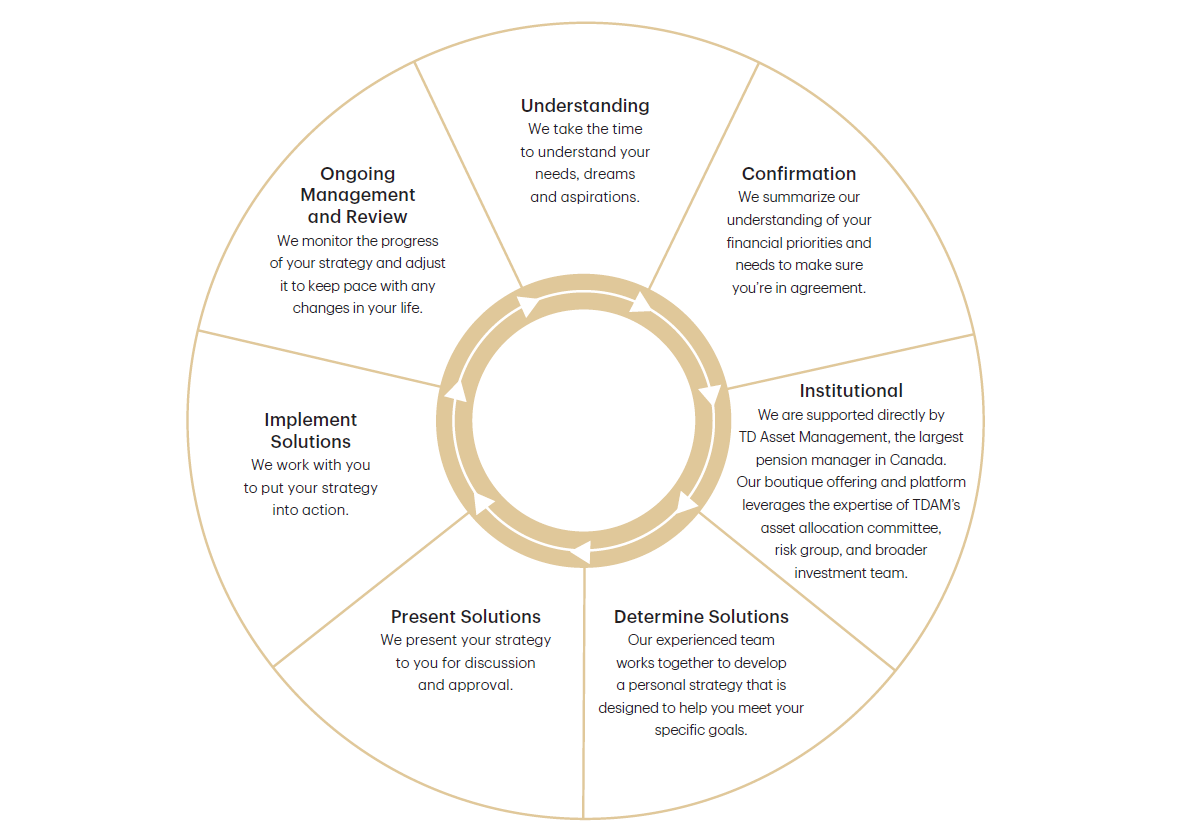

At TD Wealth Private Investment Counsel, our boutique investment offering is supported by the same high-calibre people, methodologies and rigour used by TD Asset Management Inc. with its institutional clients such as pension funds and foundations.

An institutional investment approach inspired by best practices from pension funds and foundations for affluent investors based on responsible growth and capital preservation over speculation.

Goals-based approach to help clients grow, protect and transfer their wealth.

Active investment management through a discretionary approach, which frees clients from the day-to-day portfolio management responsibilities.

Diversification is what we do. We don't collect investments; we meticulously combine and manage them based on your goals.

Clients are involved in the design of the portfolio from the asset allocation level.

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.